Those who "sell water" make more money than those who "mine", which continues to happen on the new consumption track.

On September 2, Shandong Xinjufeng Technology Packaging Co., Ltd. (hereinafter referred to as "Xinjufeng") was listed on the Growth Enterprise Market of Shenzhen Stock Exchange, with the issuing price of 18.19 yuan/share and the closing price of 19.47 yuan on the first day; A week later, the stock price dropped to 15.68 yuan, with a total market value of 6.586 billion, while the P/E ratio was 46 times higher.

This company, founded in 2007, specialized in the subdivisions of "aseptic packaging" from the traditional packaging industry, and spent 15 years moving from behind the scenes to the front. The "gold owners" behind it are Yili, New Hope Dairy, Huishan Dairy, Wanglaoji, Eurasian Dairy and other brands.

Before the listing of New Jufeng, more than ten consumer packaging enterprises, including Fenmei Packaging, Jiamei Packaging and ORG, had successfully "landed" in the capital market. Compared with those popular online celebrity consumer goods brands that are losing money, these obscure enterprises are quietly making money.

In addition, there is Hengxin Life, a paper cup supplier of Xicha and Ruixing; Ternary organism of erythritol supplier in Yuanqi Forest; Jiahe Food, the fat powder supplier of the Snow City; Nongfu Spring and Coca Cola's fruit juice supplier Tianye Shares; Dexin Food, a supplier of tea drinks and thick syrup for Starbucks, Ruixing and Naixue, has been listed or is in the process of IPO.

These companies that make money quietly are only a small part of the traditional packaging industry. To understand this competitive "water selling" industry, you can start from the overall situation.

Traditional packaging industry is taking a new position

According to the industrial chain structure, the upstream of the food packaging industry is the raw material supply chain supplier, the midstream is the production supplier, and the downstream is the subdivided application field. Including infrastructure and application skills such as packaging equipment, packaging design, packaging technology and packaging process.

According to the data distributed by the China Packaging Federation, the market size of China's food packaging industry began to show a negative growth after reaching 704.6 billion yuan in 2016 and dropped to 603.9 billion yuan by 2020. With the promotion of "plastic restriction order", "double carbon" and other policies, the number of food packaging enterprises registered in China has dropped to 54082.

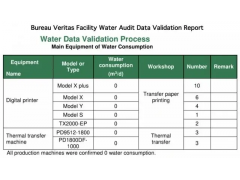

With the improvement of the national requirements for environmental protection and sanitation, and the rising cost of market raw materials, the survival of small and medium-sized packaging enterprises without technological and financial advantages is becoming increasingly difficult, and the industrial concentration and head effect of the industry will become more and more obvious. Whale traders sorted out a number of relevant listed enterprises in the food packaging industry, as shown below:

Through sorting out and research, it is found that the industry characteristics and development trends of these leading food packaging enterprises are as follows:

1、 From the perspective of capital and finance, the industry profit indicators of food packaging head enterprises are better than those of some traditional shopping mall retail channels and online celebrity flow consumer goods brands; In addition, the industry is experiencing the phenomenon of "increasing income without increasing profit" under the circumstances of epidemic trouble and rising cost of raw materials; The upside down of market value and revenue scale reflects that the industry needs to pay "technology premium" rather than "scale premium".

2、 The technology premium space of the food packaging industry is far less than that of the new energy field. The former has entered a highly "internal volume" stage of winning by volume, while the latter is in the middle of the technical dividend of "combining material technical barriers with packaging technology". For example, here the Whale Company deliberately counted Enjie shares. In fact, food packaging is just one of the company's business segments. Its industry-leading technologies of lithium ion isolation film (base film and coating film) and BOPP film (smoke film and flat film) just caught up with the explosion of demand for new energy car batteries, and its profitability is far higher than that of other peers.

3、 The food industry packaging industry needs premium and growth from manufacturing to service. Take ORG as an example. After 28 years of development, this enterprise, which was founded in Wenchang, Hainan Province in 1994, has transformed from a food and beverage packaging factory to a one-stop packaging service provider of products (R&D, manufacturing)+services (packaging design+packaging+brand marketing). This mode is very similar to Ma Yunkou's "new manufacturing".

4、 The average age of these leading enterprises is more than 20 years old. For new entrepreneurs who want to enter the food packaging industry, unless there are revolutionary products with new materials and technologies, the industry is becoming more and more highly segmented. In fact, the recently listed New Giant Fung can break through the tight encirclement from thousands of troops, largely focusing on the "aseptic packaging" market segment.

Below, we can deeply understand the subdivided development trend of the food packaging industry by disassembling the case of Xinjufeng in detail.

It has entered the era of "increasing income without increasing profits"

Yuan Xunjun, a lawyer and his wife from the 70s and Guo Xiaohong from the 60s, jointly founded New Jufeng in 2007. After that, the two people took Xinjufeng to invest and build the factory, obtained the production qualification certificate, officially started the production of sterile packaging materials, and brought in professional material packaging experts as partners.

They used their accumulated resources and contacts to win the cooperation with Yili Group, Wandashan Dairy, Xiajin Dairy and other dairy brands. Among them, Yili still holds 4.8% of the equity of Xinjufeng until the IPO, while bringing a large number of orders to Xinjufeng.

With the growth of its business and the improvement of its popularity in the industry, in 2016, Xinjufeng completed its shareholding reform, introduced seven investment institutions, including Hangzhou Yongchuang, Morning Capital and Guoli Minsheng, and the second factory project was completed in the same year. After 2019, Xinjufeng also won investment institutions such as Heihe Group, Housheng Capital and Maotai Jianxin Fund.

According to the shareholder structure disclosed in the prospectus of New Jufeng, it is a conventional phenomenon that downstream consumer goods brands hold shares in upstream packaging enterprises. In the aseptic packaging market at home and abroad, international brands are still in the leading position.

According to the research report issued by Ipsos, in 2020, Tetra Pak's aseptic packaging sales accounted for about 62% of the global aseptic packaging market sales, SIG accounted for 11.3%, Fenmei Packaging accounted for 12.0%, and Xinjufeng accounted for 9.6%. The advantages of overseas brands are significant, and the market share of Xinjufeng is not the highest.

However, in China's packaging industry, the enterprises in the middle and low-grade packaging markets are small. Relying on the advantages of technology and scale, Xinjufeng has rapidly formed barriers in the domestic market and become one of the explorers of domestic aseptic packaging brands.

The development potential of liquid milk and non carbonated soft drinks is considerable. According to the In depth Research Report on China's Dairy Industry in 2021 jointly released by Securities Daily and Haitong International, it is estimated that the sales scale of China's dairy products market will reach 810 billion yuan in 2025. Under this domestic background, Xinjufeng, seizing the development opportunity, has steadily increased its share in the sterile packaging market.

From 2018 to 2020, the market share of liquid milk aseptic packaging of Xinjufeng will be 8.9%, 9.2% and 9.6% respectively. With the increase of market share, Xinjufeng has achieved better economic benefits. According to the prospectus, from 2019 to 2021, it will achieve operating revenue of 935 million yuan, 1014 million yuan and 1.242 billion yuan respectively, with a compound growth rate of 15.24%; The net profits were 116 million yuan, 169 million yuan and 157 million yuan respectively.

In 2021, it will increase income but not profit. Xinjufeng believes that the main factor lies in the rising prices of raw materials such as paper, polyethylene and aluminum foil. In the first half of 2022, the operating income of Xinjufeng was 696 million yuan, up 31.63% year on year; The net profit was 72 million yuan, down 10.72% year on year. The reasons are similar to those in 2021, because of macroeconomic depression, commodity prices, raw material costs and other factors.

In fact, despite the cost of raw materials and other issues, Xinjufeng has other "hidden worries".

There are many powerful enemies, but they also rely too much on the head of a single customer

The relationship between Yili and Xin Jufeng, like Naixue's tea and Tianye Shares, is a win-win cooperation between big brands and major suppliers. Its logic whale business is analyzed in The Bottom: Naixue's Tea, Tea 100 Way, Yidian, and the Company Behind Aunt Shanghai. The prospectus of New Jufeng disclosed its top five customers, namely Yili, New Hope Dairy, Huishan Dairy, Wanglaoji and Eurasia Dairy.

Their income contribution to Xinjufeng will account for 91.78%, 89.16% and 89.95% of the main business respectively from 2019 to 2021. The proportion of sales revenue to Yili was the highest, 73.13%, 70.77% and 70.29% respectively. It can be seen that Xinjufeng has a large business dependence on Yili.

Although Yili's market share has risen steadily since 2017, relying on head customers is a "double-edged sword": on the one hand, it can bring stable income to enterprises; On the other hand, once there is a major change in Yili, the impact on Xinjufeng will also expand.

The rival of Xinjufeng on the same track, the more prominent one is the colorful packaging that also started in Shandong; Internationally, it is Tetra Pak and SIG. Fenmei Packaging was listed on the Hong Kong Stock Exchange as early as 2010. According to previous financial reports of Fanmei, 2019, 2020 and 2021. Its operating income was 2.707 billion yuan, 3.068 billion yuan and 3.503 billion yuan respectively, and its net profit was 337 million yuan, 343 million yuan and 285 million yuan respectively.

These two data are better than that of Xinjufeng, which may be related to such factors as the start of Fanmei and earlier integration with the international market. In addition, during the expansion of Fanmei, it also spent 106.457 million yuan to acquire all the shares of Qingdao Likang Food Packaging Technology Co., Ltd. and Beijing Digital Communication. The former brings great benefits to Fanmei in terms of technology and patents; The latter needs to be improved. International brands Tetra Pak and SIG Group are more afraid of Xinjufeng and Fanmei.

As the industry leader, they have been leading the development of aseptic packaging industry. In addition, the R&D investment volume is large, occupying a large market share. Although Xinjufeng has accumulated more than 28 core technologies, mainly focusing on solving the key problems of aseptic packaging production and process, forming competition in the domestic market, according to relevant data statistics, Tetra Pak has more than 5000 patents, and the number of patents under application and research and development has also reached nearly 3000.

The cost of Tetra Pak once accounted for 40% of the cost of each carton of milk, which made Inner Mongolia Niu and Yili use Tetra Pak, and the profit would be negligible.

In order to break through the technical repression of international brands, the R&D expenses of Xinjufeng in the reporting period were 221900 yuan, 4386100 yuan and 8323900 yuan, respectively, accounting for 0.02%, 0.43% and 0.67% of the operating revenue. In the prospectus, Xinjufeng said that the company attached great importance to and did its best in product innovation, but its R&D expense rate was significantly lower than the average of the domestic food and beverage packaging industry, and it still needed to further improve its R&D ability and product competitiveness.

In fact, Xinjufeng was founded more than half a century later than Tetra Pak, and its accumulation in capital, manpower, technology, etc. was relatively insufficient. If you want to further increase the market share, you need to not only strengthen the level of research and development, but also expand product categories, expand sales channels, and conform to the current trend of consumer diversification.

The packaging industry has a long collection cycle and a high risk of bad debts

Xinjufeng plans to raise 1.146 billion yuan from its listing, which will be mainly used for 5 billion packages of sterile packaging materials expansion project, 5 billion packages of new sterile packaging sheet materials production project, R&D center (Phase 2) construction project and other planning projects. The purpose is to make aseptic packaging products more diversified, greatly improve production capacity, and control product quality more strictly.

It is worth noting that the industry attribute of Xinjufeng determines that its collection cycle is relatively long. In its development, accounts receivable grow rapidly and account for a high proportion of total assets. From the end of 2019 to the end of 2021, the balances of accounts receivable of Xinjufeng were 263 million yuan, 264 million yuan and 393 million yuan, respectively, accounting for 28.13%, 26.02% and 31.65% of the operating revenue. The growth in 2021 is attributed to the rapid business growth.

Due to the impact of Huishan Dairy's bankruptcy reorganization event in 2017, the amount of accounts receivable overdue for more than one year since 2019 has increased rapidly. Therefore, Xinjufeng increased the amount of bad debt provision. At the end of 2021, the amount of accounts receivable of Xinjufeng overdue for more than one year will be 41.6784 million yuan, including 41.3146 million yuan related to Huishan Dairy, accounting for 97.18%.

It can be seen that for Huishan Dairy Event, if Xinjufeng's collection is not timely, or the business and financial conditions of the receivable customers have adverse changes, there is a risk that some or all of the receivables will not be recovered, thus causing a negative impact on their capital turnover or business performance.

In spite of this, Xinjufeng is confident in its future development. It is estimated that the operating revenue from January to September 2022 will be about 1121-1208 million yuan, with a year-on-year growth of about 30% to 40%. Whether this goal can be achieved depends on whether Xinjufeng can adjust its products in time according to customer needs and improve the stability and timeliness of aseptic packaging products for non carbonated soft drinks.

After all, there is still a big gap between the domestic aseptic packaging and the international level. The signal of going to sea is also accelerating Xinjufeng to improve its market competitiveness, expand its business scale and enhance its revenue capacity. Xinjufeng is just a "microcosm" of the development of the food packaging industry, and its difficulties and breakthrough methods are representative, or have certain reference value for the industry.